Quick access

Our partners

The SPI4 tool enables an MFI to obtain a quick and complete diagnosis of its social performances in a graphical form. SPI4 analyses and assesses the degree of implementation of the universal standards for social performance management and the principles related to client protection set out in the Smart Campaign.

What is SPI4?

SPI4 has been developed using Microsoft Excel and is available free of charge. It has been designed to be used as a tool to assess social performance and it helps MFIs to assess their level of implementation of the Universal Standards for social performance management, which integrate the Smart Campaign’s Principles of client protection.

SPI4 provides MFIs with the possibility of collecting their social data and of generating an analysis of their social performance. The main aim is to save time in the processing of information in order to be in a position to quickly identify the MFI’s shortcomings in the area of social performance and to take measures to address these issues.

Download the SPI4 tool free of charge from the Cerise website or ask for an SPI4 audit to be carried out to assess your social performance.

What are the universal standards for social performance management?

The universal standards for social performance management are a collection of good practices designed to help MFIs to optimise their social performance and to achieve their social goals. These standards have been created by the SPTF (Social Performance Task Force) thanks to the collaboration of a large number of microfinance professionals throughout the world. The SPTF has collected all of these universal standards in a manual which describes the standards (to be implemented by an MFI) and the fundamental management practices to be introduced in order to achieve these standards.

The SPTF’s manual of universal standards for social performance management is available free of charge in French, English, Spanish, Arabic and Russian.

What are the Smart Campaign client protection principles?

The Smart Campaign is housed at ACCION International’s Centre for Financial Inclusion.

The Client Protection Principles are comprised of seven core principles which have been identified by the Smart Campaign and which should be adhered to in order to ensure that microfinance clients are dealt with in a responsible way:

- Appropriate product design and delivery

- Prevention of over-indebtedness

- Transparency

- Responsible pricing

- Fair and respectful treatment of clients

- Privacy of client data

- Mechanisms for complaint resolution

Each of these seven principles has been translated into standards to be adhered to in order to provide clients with the best possible level of protection. The Smart Campaign has defined a total of 30 client protection standards and these standards have been integrated within the SPTF Universal Standards.

The SPI4 tool assesses the implementation of the SPTF Universal Standards, which include the Smart Campaign’s 30 client protection standards.

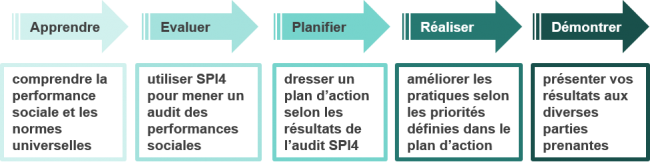

How should the SPI4 be used?

The SPI4 tool can be downloaded free of charge from the Cerise website. However, Cerise strongly recommends that anyone who intends to use it should go on a training course in order to fully understand how to use SPI4 and the results which it generates.

You can choose to fill in the SPI4 on your own or with an SPI4 auditor who will support you throughout the self-assessment process. If you have already completed a microfinance MFI Factsheet, it is possible to import the data automatically into SPI4.

The results of the assessment will enable you to identify the areas which require improvement. You will then be able to put forward recommendations to be applied in accordance with an action plan which you have drawn up yourself. For the purposes of this stage of the process, you may decide to extend the support provided by your SPI4 auditor by choosing the “audit +” option. In this case, the SPI4 auditor will help you to both identify and implement recommendations designed to improve your institution’s social performance.

Please contact us straight away in order to arrange the support of one of ADA?s certified auditors.

Who created SPI4?

SPI4 has been created by CERISE in collaboration with the Social Performance Task Force (SPTF), the Smart Campaign, the MIX, Truelift, Grameen Crédit Agricole Foundation, ADA - BRS, Planet Rating, the Pakistan Microfinance Network, Red Financiera Rural, CIF/West Africa, ESAF India, with the support of the Liechtenstein Development Service (LED), the Ford Foundation and the Kazakhstan Microfinance (KMF), which is a member of the Microfinance Centre, for the Russian translation.

Further information is available on the Cerise website.