Agricultural finance

Support for smallholder farmers

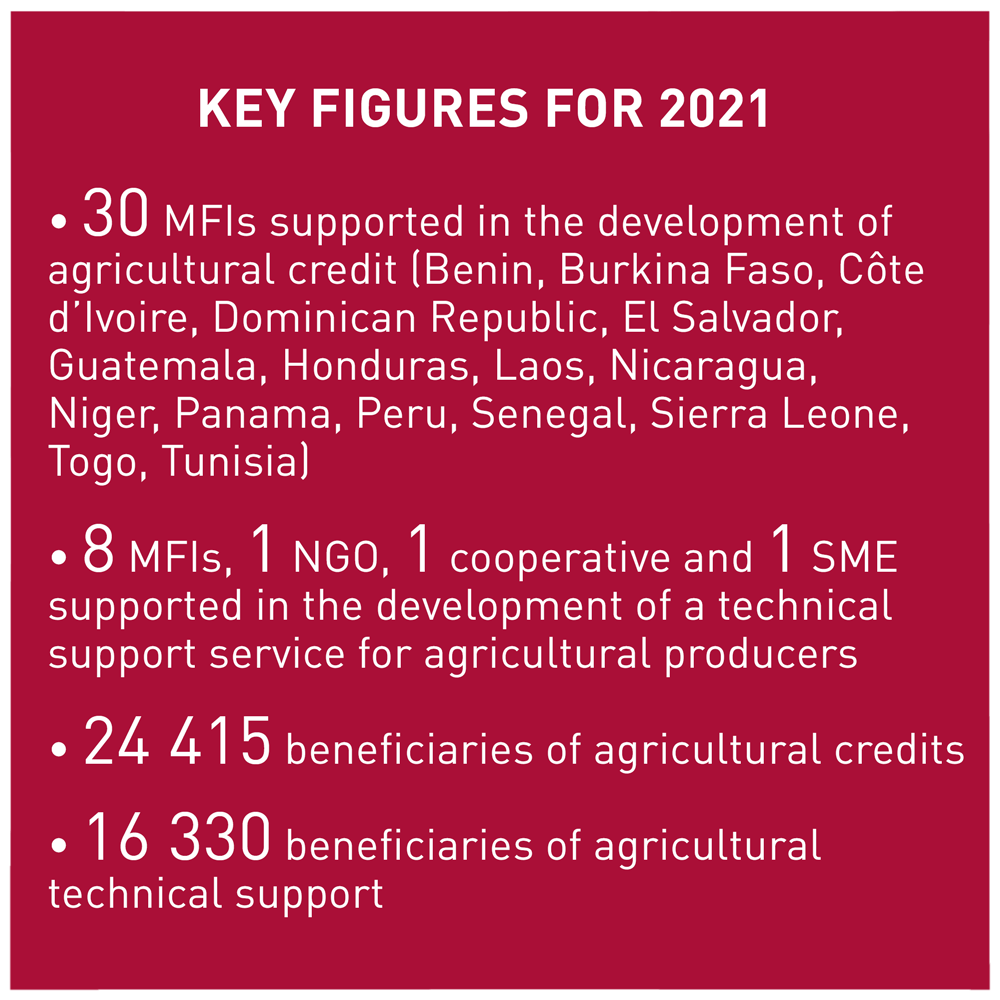

ADA strives to improve the livelihoods of smallholder farmers through improved productivity and access to appropriate financial services. To this end, ADA connects agricultural value chain actors and trains microfinance institutions (MFIs) in agricultural finance.

Farmers and other actors in agricultural and agrifood value chains in develo ping countries need access to appropriate financial services to improve their livelihoods and increase their productivity to strengthen overall food security. However, many MFIs lack the skills for managing agricultural loans, making it difficult for farmers to obtain financing to improve their production practices and to access new markets.

ADA’s support for smallscale producers is threefold. Firstly, ADA supports technical assistance projects that increase productivity and strengthen agricultural value chains. Secondly, ADA strives to connect the different actors in agricultural value chains with MFIs to facilitate the farmers’ access to financing by acting as a network coordinator. Thirdly, ADA provides training to MFIs to help them tailor their products to farmers’ financing needs. The following three projects are examples for all three approaches.

SSNUP: Increasing the resilience of smallholder farmers and agricultural value chains

The SSNUP programme (Smallholder Safety Net Upscaling Programme) aims at increasing the productivity and resilience of smallholder farmers in Africa, Latin America and Asia. SSNUP cofinances technical assistance projects that support smallholder farmers and value chain actors such as SMEs, agricultural cooperatives, MFIs and other agricultural financial intermediaries. These projects can range from developing index insurances to promoting climatesmart and agroecological farming.

F2.0: An online platform for ordering inputs and managing stocks

ADA set up the F2.0 (Farmer 2.0) web platform to connect actors in the agricultural value chain with MFIs to facilitate exchanges, transmit information and dematerialise payments. This increases the financial inclusion of groups of smallholders, reduces risks for all actors and makes the MFI’s services more efficient and more targeted to the needs of smallholder farmers.

FAR: Training in agricultural and rural finance

Together with the Ministry of Foreign and European Affairs of Luxembourg and the Food and Agriculture Organization (FAO) of the United Nations, ADA organises an agricultural and rural finance training programme (FAR) for African financial institutions or public bodies.

IN A NUTSHELL

ADA’s support for smallholders: technical assistance to increase productivity, connecting agricultural value chain actors with MFIs and training.

LATEST NEWS

30 September 2022

The training in agricultural and rural finance (FAR) 2022 is about to start in Cotonou

The second part of the training in agricultural and rural finance (FAR) with the 40 most assiduous participants of the first session in April will be held in Cotonou, Benin, from 17 to 22 October, 2022.