ADA meets beneficiaries of green loans in Central America

Since 2018, ADA has been conducting a project with its long-standing partner, REDCAMIF, the regional microfinance network in Central America and the Caribbean, which has enabled 17 MFIs in the region to either further develop or improve their green financial products and services, 6 of which also received funding from the Luxembourgish Ministry of the Environment, Climate and Sustainable Development (MECDD). ADA met clients of these MFIS who benefitted from these services.

The products and services developed by these MFIs are designed to improve the conditions of micro, small and medium-sized companies through financing practices which are more sustainable and environmentally friendly and are linked to the adaption to climate change and its mitigation. These products are notably aimed at favouring access to water and sanitation, improving housing through energy efficient technologies or optimising agricultural and livestock breeding activities thanks to the adoption of practices which are more environmentally friendly.

To fully appreciate the impact and usage of these loans by the local population, ADA visited seven MFIs in three different countries: PILAR H and Banco Popular in Honduras, Hábitat para la Humanidad, FUSAI, Credicampo and PADECOMSM in El Salvador and Financiera FDL in Nicaragua. In particular, ADA spoke to the MFI managers and to the branch managers before shadowing the credit agents during their meetings with beneficiaries in the field.

Melvin Josue Herandez is a beekeeper. He received a loan from PADECOMSM in El Salvador to finance the purchase of equipment for his activities. This enables him to contribute to the conservation of bees which, by pollinating flowers, ensure their reproduction and biodiversity.

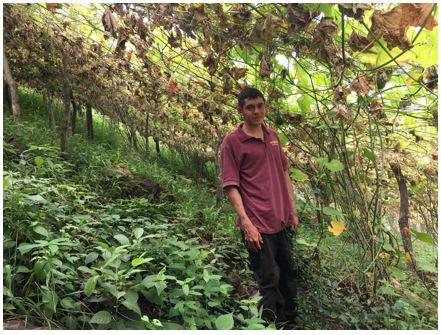

Ramon Dionisio Guevara is a client of PADECOMSM. He was able to plant chayotes, which are green vegetables and are members of the Cucurbitaceae family. He also received technical assistance in addition to the loan to enable him to adopt practices which are not polluting or damaging to the environment (how to use crop residues without resorting to burning them, optimising water usage, etc.).

Augustin is a client of PILARH in Honduras. The credit financed part of his pulper. This machine makes it possible to separate the pulp from the skin of the coffee beans and to recover the water extracted during this process. This water, which is green in colour, is called aguamiel. Augustin will reuse it as a biofertilizer for the coffee trees.

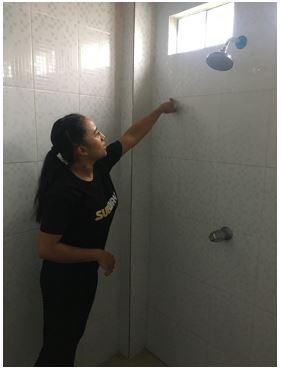

Maria Elvira García is a client of Hábitat para la Humanidad in El Salvador. She obtained a loan to renovate her shower and sanitation facilities. Having a septic tank or a dry toilet which meets the required standards means that the inspector will agree to the facilities being connected to the community’s water system.

Pastor Perez is a client of FDL in Nicaragua (to the right). The advice he gets from the MFI agent (to the left) is helping him to optimise the consumption of the grass which his cows feed on. He now knows that he needs to allow his cows to graze on a delineated patch of grass and then move them on to another patch once all of the grass has been consumed to prevent them from urinating and defecating on the consumed patch, since this can hamper the regrowth of the grass. In addition to this advice, a new chatbot-based technical assistance service via WhatsApp provides him with further real-time advice related to his livestock (in the event that one of his cattle is ill, for example).

Lessons learned will soon be available

ADA and REDCAMIF are currently gathering the lessons learned throughout this project with 17 MFIs in Central America and the Caribbean which have developed green financial products and services. The document will be available in the final quarter of 2022 and will be presented at the REDCAMIF annual conference in March 2023.

- Log in to post comments