Farmer 2.0

F2.0: an online inclusive agricultural finance platform

ADA designed an online platform to facilitate the management of loans by microfinance institutions (MFIs) to remote smallholder farmers and their cooperatives to finance the purchase of inputs and the management of stocks in an efficient and profitable manner.

While MFIs benefit from streamlined loan management and reduced risk, farmers can open a bank account and access financing to receive timely inputs. Cooperatives on the other hand can make a profit by selling the harvested produce over time by managing their stocks in response to market demand.

Despite the fact that the majority of the African population work in agriculture, the agricultural sector in general and smallholder farmers and their cooperatives in particular remain grossly underfinanced.

While financial institutions shy away from the high risk, large administrative burden and low profitability of financing smallholder farmers, cooperatives are often too poor to receive financing beyond the most urgent need of purchasing inputs. This lack of further funding prevents the cooperatives from growing their business which would in turn enable them to better serve their communities.

ADA has taken a holistic approach to resolve this deadlock by developing the online credit and stock management platform F2.0 (Farmer 2.0) which meets the business management and financial needs of both agricultural cooperatives and MFIs for the benefit of the vulnerable smallholder communities they serve.

How it works

F2.0 offers benefits to all beneficiaries – MFIs, cooperatives and smallholder farmers.

Streamlined credit management for MFIs

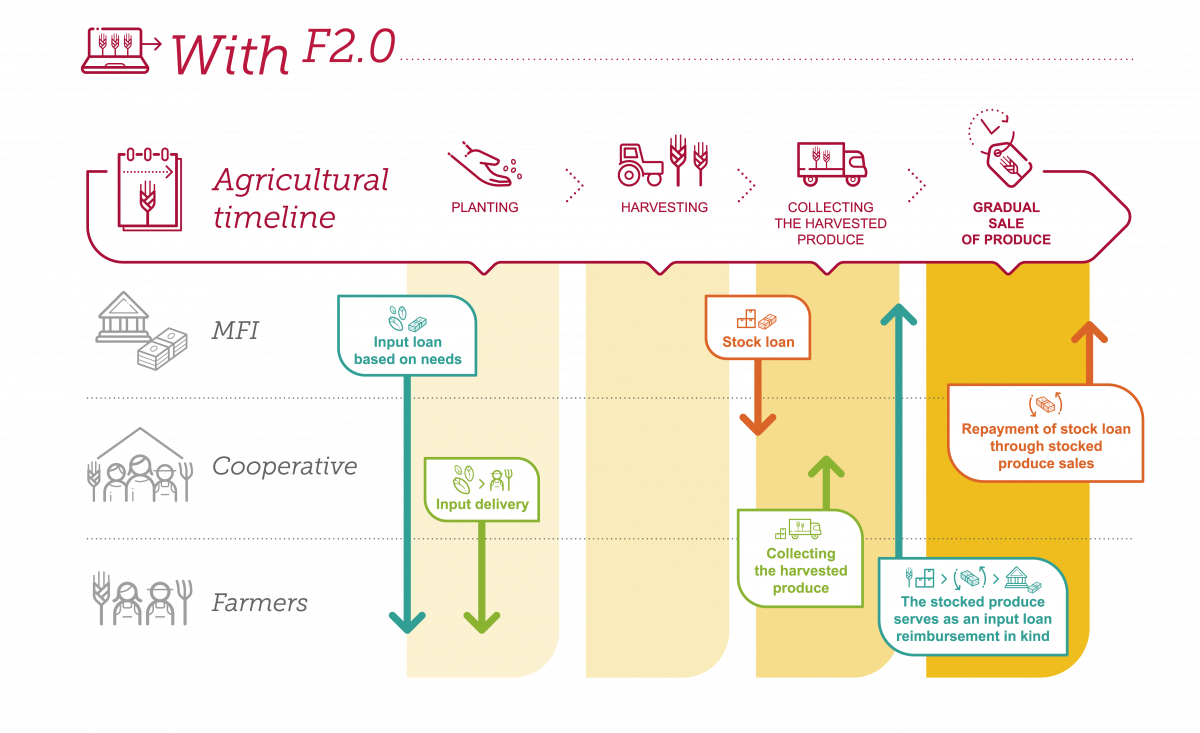

F2.0 enables MFIs to communicate with cooperatives and other agricultural value chain actors. This direct information from the field enables the MFI to get an overview of the financing needs of the smallholder farmers, disburse loans accordingly and monitor the status of their reimbursements.

These input loans are granted directly to the smallholder farmers via their own newly opened bank account. This financial inclusion opens up further banking and insurance possibilities via the MFI at a later stage, thereby improving the quality of life of the smallholder farmers.

F2.0 enables both the cooperatives and the MFIs to monitor the delivery of the harvested produce, which serves as credit reimbursements in kind. This monitoring not only reduces the loan administration, it also serves as a risk management tool for the MFIs as they can easily track the credit status of smallholders.

In addition to managing the loans provided to smallholder farmers, F2.0 also enables the MFI to manage loans to cooperatives and other farmer organisations.

Efficient and profitable stock management for cooperatives

As cooperatives are poor, they are only eligible for one loan which was traditionally used for purchasing inputs. F2.0 gives them more flexibility: as the loans for purchasing inputs are now taken out by the farmers directly, the cooperative is freed up to request a loan to stock the harvested produce instead.

The F2.0 stock monitoring tool reassures MFIs of the cooperatives’ creditworthiness as they are only providing the cooperatives with a loan for purchasing stocks which have actually been delivered and which can hence serve as collateral.

In this manner, the cooperatives receive funding to purchase the harvested produce from their smallholder members for resale at an advantageous price later in the year when market demand picks up in the months after the harvesting season. F2.0 not only enables them to monitor their stock but also connects them to the market so that they can monitor demand.

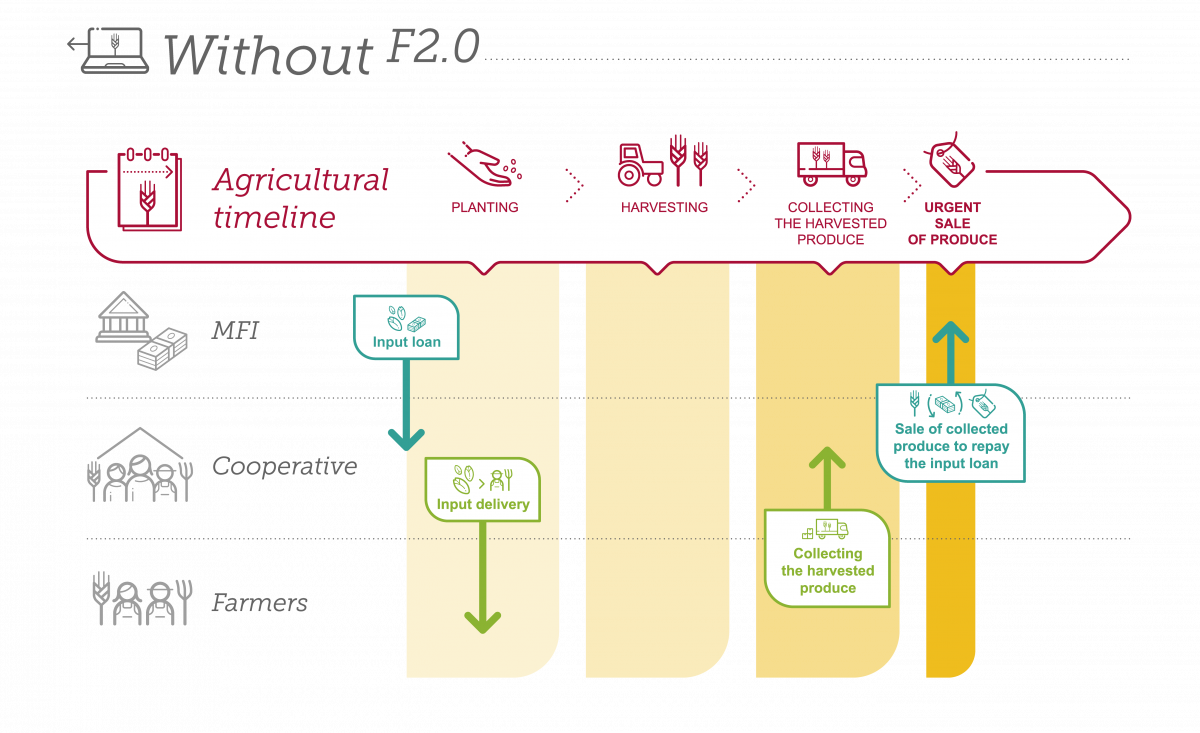

This opens up new opportunities for cooperatives to make a profit – without F2.0, cooperatives are forced to simply collect the harvested produce from their members and to sell it immediately at the least profitable time to meet the stringent input loan reimbursement deadlines (agricultural loans traditionally never exceed a period of ten months in Africa).

Access to finance and social benefits for smallholder communities

F2.0 provides multiple benefits for vulnerable smallholder communities. Individual farmers gain access to finance and enjoy a repurchase guarantee of their harvested produce by the cooperative at a fair price. This strengthens the quality of life of vulnerable households as farmers have a more stable and predictable source of income as well as access to savings and insurance products which make them more resilient to shocks.

On the community level, a profitable cooperative is able to improve infrastructure such as storage facilities and can support farmers struggling with loan repayments to ensure the cooperatives remains eligible for loans under F2.0.

Key figures for 2023

F2.0 started as a pilot project in Senegal in 2020.

In 2023, through 8 partner MFIs and around 50 farmers’ organisations, the programme financed:

— Input loans worth €2.4m for 7,400 small-scale producers;

— Storage loans totalling €1.7m for the 50 or so farmers' organisations.

IN A NUTSHELL

ADA’s F2.0 online platform connects smallholder farmers and cooperatives with MFIs to give them access to tailored and efficient agricultural financing. In addition, streamlined input and stock management increases the profitability of the cooperatives, strengthens income security for farmers and reduces risk for the MFIs.