SSNUP project completion: Improving the investment readiness of farmer cooperatives in Cambodia

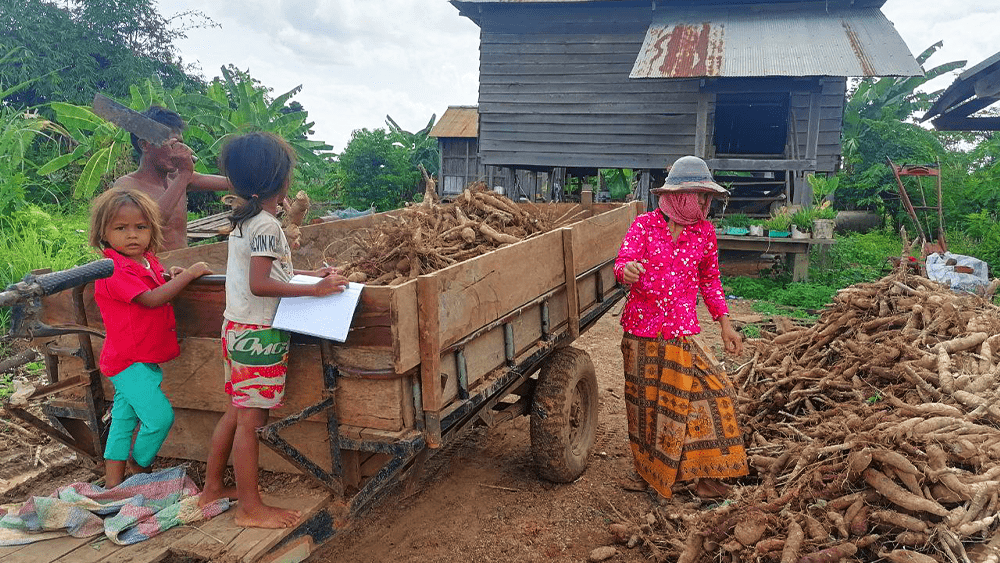

© Chamroeun Microfinance Plc.

Between 2021 and 2023, the microfinance institution Chamroeun Microfinance Plc. - investee of Oikocredit - successfully implemented a project co-funded by SSNUP to improve farmer cooperatives' investment readiness in Cambodia.

Chamroeun has identified Smallholder Farmer Cooperatives (SHFCs) as a niche in need of finance that can support the portfolio's growth in the agricultural sector in an efficient way. However, while there are more than 1,200 SHFCs in Cambodia, only a small portion has the scale and financial sustainability required to be eligible for commercial loans to finance their operations.

The project was designed to address the critical financing gap faced by SHFCs through tailored financial products and a capacity-building programme to strengthen their business and financial management.

A total of 46 SHFCs, representing 16,345 individual farmer members, benefited from the project:

- 37 SHFCs participated in the capacity-building programme. They received training on business plan, business operation and financial management to manage their operations more effectively and attract further funding;

- 41 SHFCs received a loan, 34 of which were first-time loan recipients. These loans, backed by third parties, were instrumental in providing SHFCs with the necessary capital to finance crop production initially and then buy produce from farmers in a timely manner, enhancing their operational efficiency and attractiveness to members.

Chamroeun’s SHFC portfolio experienced significant growth during the project, making it the leading financial service provider in the SHFC market niche.